Chinese science community mourns passing of Tsung-Dao Lee, renowned Chinese American physicist and Nobel laureate

Tsung-Dao Lee, Chinese-born American Nobel Prize winner in Physics, renowned for his contributions to high-energy physics and his role in advancing China’s science education, passed away in the US early Monday morning at the age of 97.

The Tsung-Dao Lee Institute and Tsung-Dao Lee Library at Shanghai Jiao Tong University and China Center for Advanced Science and Technology jointly issued an obituary to mourn with deep sorrow the passing of Lee at his home in San Francisco, California.

Born in Shanghai on November 24, 1926, Lee developed interest in physics at an early age. In 1957, he won the Nobel Prize in Physics with Chen-Ning Yang, another renowned Chinese physicist, for advancing parity nonconservation in weak interactions, overturning what had been considered a fundamental law of nature that particles are always symmetrical.

Lee served as a foreign member of the Chinese Academy of Sciences, an academician of the National Academy of Sciences of the United States, the lifelong director of the China Center of Advanced Science and Technology, an honorary professor of Shanghai Jiao Tong University, and an honorary director of the university’s Tsung-Dao Lee Institute.

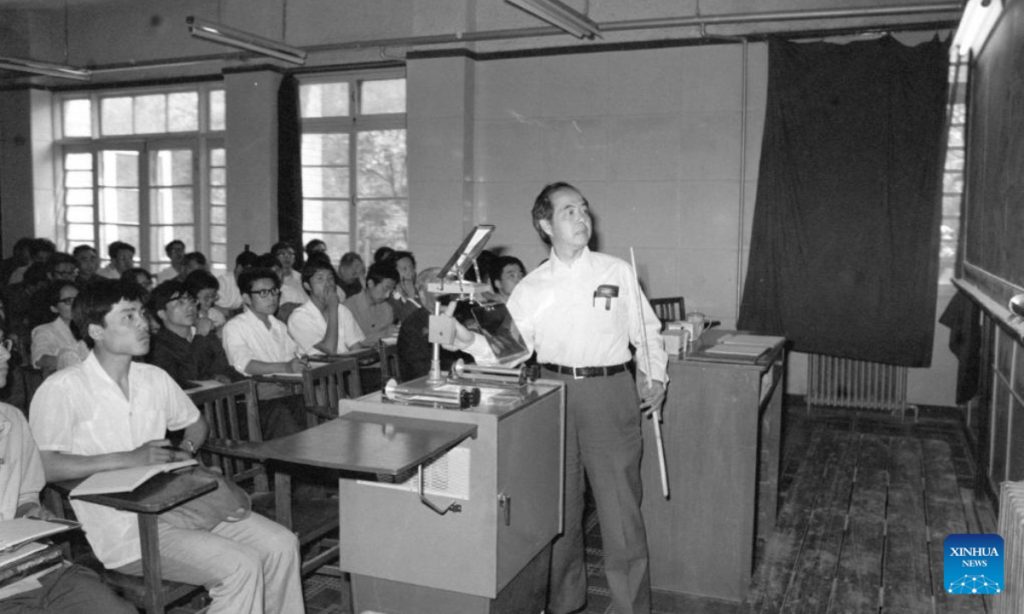

Throughout his more than 60-year academic career, Lee pursued rigorous scholarship, seeking breakthroughs and continually reaching new scientific heights in various fields such as quantum field theory, fundamental particle theory, nuclear physics, statistical mechanics, fluid mechanics and astrophysics. He made enduring and significant contributions to the development of physics, the obituary reads.

In addition to his cutting-edge research outcomes, Lee was deeply respected for his efforts in cultivating Chinese science talents and contributing to the development of the study of physics in China.

He vigorously promoted the development of high-energy physics in China through China’s first physics collider, the Beijing Electron-Positron Collider.

He facilitated the establishment of the “Special Class for the Gifted Young,” an educational model created at the University of Science and Technology of China.

He also initiated the China-US Physics Examination and Application (CUSPEA) program for selecting physics postgraduate students, and advocated for the establishment of systems such as postdoctoral positions and the National Natural Science Foundation of China.

On hearing the news about Lee’s passing away, many scientists in China expressed their condolences.

Yan Ning, an academician of the Chinese Academy of Sciences (CAS), and founding president of the Shenzhen Medical Academy of Research and Translation, said on Monday afternoon on her social media account that the death of Lee is “the fall of a giant star.”

Tang Chao, an academician of the CAS and head of the National Natural Science Foundation of China's interdisciplinary science department, said that the CUSPEA program initiated by Lee more than four decades ago had trailed a blaze in sending Chinese students to study in the US.

This forward-looking, groundbreaking initiative opened the door to “going global,” marking a significant historical achievement and bearing great historical significance, Tang wrote in a statement, noting that the program also changed people’s destiny.